Here in this article we will provide complete information about Rivian Automotive Inc (NASDAQ: RIVN) along with Rivian stock price predictions for 2023, 2024, 2025, 2030, 2040, and 2050.

This post is based on our 7 years of experience in the market. Hope you will like this Rivian price forecast information, and please share this informational & valuable article with your friends.

What Is Rivian Automotive Inc?

Rivian Automatic Inc is an American electric vehicle manufacturing company founded in 2009 by Robert “RJ” Scaring. The headquarters of Rivian is located in Irvine, California, US.

The main vision of Rivian is to manufacture SUV-type vehicles such as Pickup trucks or UTEs. Rivian has also produced E- Vans for the largest E-commerce company, Amazon.

The company launched its IPO in Nov 2021 by raising over $13.5 billion USD. Investors invested in this company with a vision that Rivian could become a major competitor of TESLA.

There are a lot of investors and traders who are highly interested in knowing Rivian stock price predictions for 2025.

| Valuation Measures | Value/Price |

|---|---|

| Market Cap | 29.25 B |

| Enterprise Value | 3.93 B |

| 52 Week High | 179.47 USD |

| 52 Week Low | 19.25 USD |

| S&P500 52-Week Change | -4.31% |

| Price/Sales (TTM) | 84.53 |

| Price/Book (MRQ) | 1.05 |

| Enterprise Value/Revenue | 71.37 |

| Enterprise Value/EBITDA | -0.88 |

| 50/200 Day Moving Average | $29.92 / $57.98 |

The above table display information about Rivian Automotive, Inc. (RIVN) Stock Price, market cap, and 52-week high and low along with some other important information like S&P500 52-Week Change in Rivian. Data from the above table was taken on 12/05/2022 from Yahoo Finance. If you want to see live data then check out here.

Rivian Stock Price Prediction 2025

| Year | Rivian stock price prediction 2025 |

|---|---|

| 2025 | $185 to $230 |

Rivian stock price prediction 2025

Rivian stock price prediction for 2025 is $185.35 as the first target and $230.46 as the second target. Overall, in 2025, the Rivian stock price forecast is it could range from $188.34 to $246.45.

These price predictions are achievable as demand for EV cars is increasing day by day and Rivian is getting success in establishing contracts for supplying to various companies.

Last year, Rivian secured a deal with Amazon for providing 100,000 electric delivery vans, which pushed up demand for their electric vans. There is one more EV maker in the market called Lucid Motors.

Rivian Stock Price Prediction 2030

| Year | Rivian stock price prediction 2030 |

|---|---|

| 2030 | $745.34 to $845.45 |

Rivian stock price prediction 2030

Rivian stock price prediction for 2030 is $745.34 as the first target and $845.45 as the second target. Overall, in 2030, the Rivian stock price forecast could range from $745.34 to $845.45.

After Tesla’s cyber truck, Rivian is the most popular brand in Pickup trucks (SUVs) and their designs are unique and beautiful. As they are more focused on Utility trucks, so they could become one of the best EV manufacturing companies in the SUV class of vehicles. Their vehicles are designed for Off-road as well, which makes them more unique on their own.

Once, the demand for EVs kicked in, then the demand for EV cars will increase and people will buy Rivian vehicles as well which will increase their profit. Ultimately, the share price of Rivian will go up in 2025 and gradually increase till 2030 and could hit our targets.

Rivian Stock Price Prediction 2040

| Year | Rivian stock price prediction 2040 |

|---|---|

| 2040 | Around $1500 |

Rivian stock price prediction 2040

Rivian stock price prediction for 2040 is around $1500. In 2040, Rivian will become 30 years old company and if products of Rivian perform well in the market then for sure these price targets are reachable.

According to the technical analysis made by our experts, the price target is 80% accurate for the stock price of Rivian in the years 2025, 2030, and 2040. If the company exist for years, then the trust and the brand value will increase along with the sales and the profit of the company.

Just like Lucid Motors & Rivian, there is one more EV maker called NIO. We have researched and written a detailed post on What Will Be The Price Of NIO’s Stock from 2022 to 2050. Read it to know more.

Rivian Stock Price Prediction 2022

| Year | Rivian stock price prediction 2022 |

|---|---|

| 2022 | $45 to $70 |

Rivian stock price forecast 2022

As per our technical analysis and current market situation, the Rivian stock price forecast for 2022 is $45 as the first target and $70 as the second target.

Overall, the Rivian stock price forecast says it will range between $45 to $70 in 2022. Rivian has performed very well and is expected to perform better in 2022.

Rivian Stock Price Prediction 2023

| Year | Rivian stock price prediction 2023 |

|---|---|

| 2023 | $123- $157 |

Rivian stock price forecast 2023

Rivian stock price will range between $123 and $157 in 2023 as per our price prediction. The company is pushing its capabilities very hard to improve the production rate. So, they can sell more cars and make more profit.

Rivian Stock Price Prediction 2050

| Year | Rivian stock price prediction 2050 |

|---|---|

| 2050 | Around $2349 |

Rivian stock price forecast 2050

Rivian stock price prediction for 2050 is around $2349. These price forecasts are based on technical analysis made by different software and tools.

The main component of an electric vehicle is its battery. Batteries are like the backbone of every electric vehicle. Mainly, these batteries are made up of Lithium. If the sales of EV will increase, then the sales of Lithium batteries will also increase. So it is very important to know about those companies and their stocks.

We have researched and selected the Best Lithium Batteries Makers and their stocks. Read it to know more.

Rivian Stock Price Forecast 2022, 2025, 2030, 2040, 2050

| Year | Rivian stock price prediction |

|---|---|

| 2022 | $45 to $70 |

| 2025 | $185.34 to $2360.45 |

| 2030 | $745.35 to $845.45 |

| 2040 | Nearly $1500 |

| 2050 | Around $2349 |

Rivian stock price prediction 2022, 2025, 2030, 2040, 2050

Above table display information about Rivian price forecast in the year 2022, 2025, 2030, 2040, and 2050 on the base of technical analysis done by experts.

Should I buy Rivian stock?

Yes, as per our analysis Rivian is a good stock to buy because of many reasons such as

- They are mainly focused on utility trucks, as per research, doing business in a particular niche has more chances of getting success.

- Currently, the EV boom has to come. So, people who start early when some revolution is about have more chances of getting success.

- As tesla is dominating EVs. What do you think? That only they will dominate in EV for the next decade?

- Do you trust in long-term investment? If yes, then Rivian stock is a good one to buy now to hold for a year to make a massive profit. As per experts, only those people who get success in the stock market spends time in it instead of timing it.

FAQ: People also ask:

Should I Buy Rivian shares?

It depends on your investment goals. Currently, Rivian is facing problems in production because of the supply chain. So, if production is slow means less fulfillment of orders and less profit. So, it could be a risk to invest in Rivian, and could become good as well, it all depends on production at the moment.

Will Rivian Stocks Grow In The Future?

Yes, in the stock market you can’t say it will grow or not as well it all depends on the fundamentals of the company as well. 290,000 vehicle delivery is expected by 2025 with $25.8 billion in revenue. 701,918 vehicle delivery is expected by 2030 with $78.7 billion in revenue. So, from these figures, you can expect what could happen.

Why Is Rivian stock So Low?

Currently, the company is facing problems with mass production and delivery due to supply-chain shortages. Fewer deliveries of cars mean fewer sales, and fewer sales mean less profit. If a company is not making a profit, it is certain that its share price will go down or that there are any issues going on inside the company’s management.

These days, the news is getting viral about the upcoming recession. So, people are scared these days and do not put their money into shares instead they are dumping shares which causes the stock prices to go down.

Are Rivian Stocks Overpriced?

Yes, Rivian stock is overpriced based on its production, which is currently affected due to supply-chain shortages around the globe.

What Is The Prediction For Rivian Stock?

Rivian stock price prediction for 2022 is $45 to $70.

Rivian stock price prediction for 2025 is $188.34 to $246.45.

Rivian stock price prediction for 2030 is $745.34 to $845.45.

Rivian stock price prediction for 2040 is around $1500.

Rivian stock price prediction for 2050 is around $2349.

Will Rivian Stock Recover?

Yes, Rivian stock will recover in the future as the company is getting stronger day by day and acquiring more and more clients for their trucks.

What Will Rivian Stock Be Worth In 5 Years?

As per analysis, the stock price of Rivian in the next 5 years will hit 3 digits back and will trade over $500

Is Rivian Publicly traded Company?

Yes, Rivian stock is publicly traded and it is registered on NYSE with ticker code RIVN.

What is Rivian stock price prediction for 2025?

Rivian stock price prediction for 2025 is $185 to $230. RIVN can reach these price targets easily by the end of the year 2025.

Rivian Q1 2022 Earnings Results

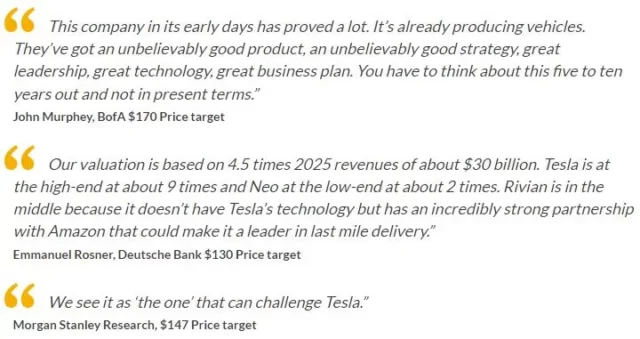

Expert forecasts on the future of Rivian Automotive (RIVN)

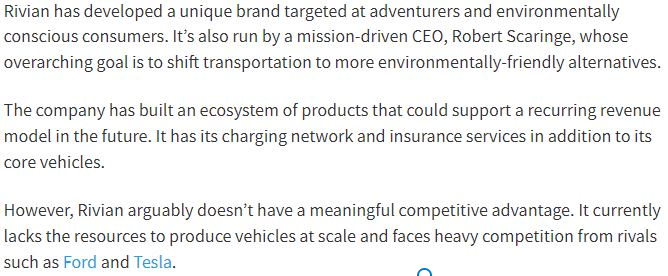

Is Rivian Stock A Good Buy?

Yes, at the current price of nearly $32 USD, it’s a good bargain. Currently, the company holds over $16 billion in cash and their sales are increasing daily they are also focusing on their products as well. Due to sexy-looking trucks, people are more interested in Rivian trucks.

The Bull Case For Rivian

Being a first mover in EVs Rivian has become the first producer for delivering EV trucks to their clients. They have already attached a huge amount of people to their trucks and have 1000s of pre-orders in their hands. Recently in 2022, Rivian secured a deal with Amazon.INC for providing them EV vans for the purpose of delivery and pickup.

The Bear Case For Rivian

Since the start of May 2022, Rivian has only produced around 5,000 E-vehicles and they are expecting to finish 2022 by producing nearly 25,000 vehicles. The production rate for Rivian is quite less in comparison to other competitors such as Ford which sold over million vehicles in 2021 and Tesla which produced around 300,000 cars in the first quarter of 2022.

Will Rivian Be Successful?

Conclusion

So in this post, we discussed Rivian Automotive Inc (NASDAQ: RIVN) market cap, share price, PE ratio, a 52-week low, and high. Also in this post main focus was on discussing Rivian stock price predictions for 2025, 2030, 2040, and 2050 based on technical analysis by experts, historical prices, and current market news.

If you guys like this article then please share it with your friends and please do check out other pages of our website and explore various topics such as crypto, NFTs, and stock market updates. Thanks a lot once again.